Wanting diversity for his ‘very significant’

Flight Centre dividends, cricket lover

Geoff Harris ended up bankrolling a

$250m private equity fund, aptly named

Straight Bat.

It is known as “Gate 8”, a $20m boutique property development taking shape in the shadows of the Melbourne Cricket Ground in East Melbourne which pays homage to Australia’s sporting Mecca.

The new seven-storey building and mixed use precinct, which has been designed with the Great Southern Stand and old MCC Members Pavillion in mind and faced two years of delays amid objections from local residents, will add a metaphorical eighth “gate” to the MCG’s seven entrances according to its creator, Melbourne

businessman Geoff Harris.

While the purpose of Gate 8 is to be a new home of entrepreneurial spirit and a hub for social innovation, it will also reflect his lifelong passion for the nation’s favourite summer pastime.

Harris reckons he was never much of a cricketer, despite making a top score of 98 as a left-handed opening bat for his school team.

“I’ve always said wouldn’t it be good just to be good enough to either play one game at the MCG in AFL or one Test match for Australia,” says Harris, a former vice-president of the Hawthorn Australian Football Club.

Harris is best known for being the co-founder of Flight Centre, the travel agency chain that has become a global success story.

The Harris family still owns 14 per cent of the $3bn company.

His wealth, worth $546m according to The Australian’s The List – Australia’s Richest 250, is now being managed by his 36-year-old son Brad in a family office known as Harris Capital, established six years ago.

Harris also has two daughters, who are not directly involved in the business. Harris Capital has investments in real estate, restaurants, hotels, private credit, property and is the home of the family’s philanthropic endeavours around homeless youth.

It will move its head office into the top floor of Gate 8 when the building opens in early 2024.

The building will also be home to the latest venture of Harris Capital, a $250m private equity fund which takes its name from Harris’s cricketing passion. It is known as Straight Bat.

“The Harris family are committed Hawthorn Football Club fans, with active involvement through their magnificent ‘three-peat’ era. I for my part follow the Richmond Tigers. Clearly, we had to put aside matters of religion, but what we had in common was our national game of cricket,” says the firm’s managing partner, former McKinsey consultant and venture capitalist Steve Gledden.

“Most people recognise the expression ‘play with a straight bat’, meaning honest, decent, straightforward, reliable, consistent long-run performance, notching up singles, rather than swinging for the fences. That’s how the name Straight Bat Private Equity was born.”

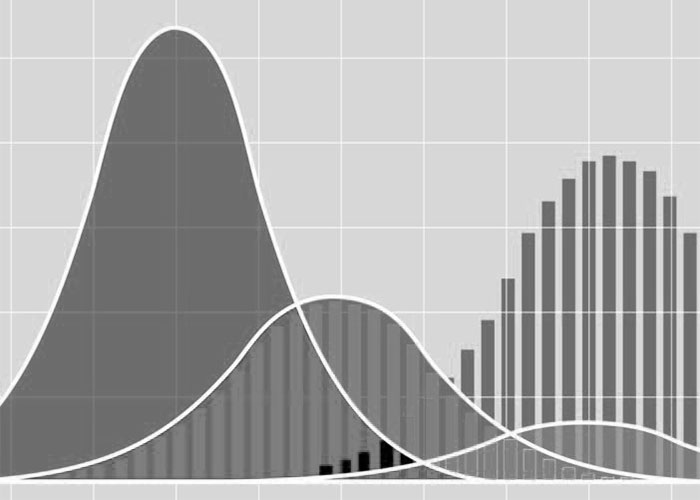

Straight Bat invests in mature and profitable medium-sized Australian businesses with revenue between $10m-$100m, EBITDA of $5m-$25m and EBITDA margins greater than 20 per cent

Keen investors

Its foundation Perpetual Legacy Fund aims to deliver 10 per cent annual return to investors. Last year they received 10.5 per cent, including franking credits.

Straight Bat seeks “long-term partnerships with proven, values-aligned founders, investing at sensible valuations” and has so far made five investments, the most recent being an unusual one for private equity in the law firm Wotton + Kearney.

The others are engineering and project management company HPS, Victorian business Toner Plumbing & Drainage, an equipment hire business RPM Hire and a dairy factory in Warrnambool.

Straight Bat now has $182m in funds under management and is raising a further $75m for the Perpetual Legacy Fund, of which almost $50m has been committed.

Other than the Harris family, its external backers include Flight Centre co-founder Bill James. PFD Food Service founders Rick and Linsday Smith, Boost Juice founder Janine Allis (Harris was one of the original backers of Boost), Wingate founder Farrel Meltzer, former Foster’s CEO Trevor O’Hoy, property magnate Steve Buxton, Aconex co-founder Rob Philpot and former McKinsey managing partner Adam Lewis.

Geoff Harris, Lindsay Smith, Meltzer and James are ongoing advisors to the group.

“Playing the long game is a Straight Bat philosophy that resonates very strongly with me,” Lewis says. “I have been a direct investor in businesses for more than 20 years and you learn that real businesses run by committed founders who are truly seeking to create something for the long-term is what drives success.”

Gledden says the proceeds of the current fund extension will be used to increase the size of the portfolio from five to eight assets. “We have a specific goal within 10 years to get to $1bn in funding. And in 30 years to get to $4bn.”

Geoff Harris says the genesis of Straight Bat came from a chance conversation with Gledden just before the onset of Covid-19.

Brad Harris had been introduced to Gledden two years earlier and together they started working to bring greater professionalism to the Harris family’s eclectic range of investments.

Harris remembers telling Gledden in March 2000: “Hey Steve, what about this as an approach? Last year we received a very significant dividend from Flight Centre. We think it would be a good idea to diversify our sources of income.”

It proved to be a prescient discussion, because only a few months later Flight Centre’s dividend income dropped to zero.

The Harris family also owns the Signature Hospitality Group, operators of The Sporting Globe and TGI Fridays chains, which were hit hard by the pandemic.

“We were in travel and hospitality and I had some freehold pubs which we were not getting any rent from. We were in industries that were smashed by Covid and we realised we needed to look at investments in businesses that were anti-cyclical,” Harris recalls.

“Berkshire Hathaway has a very boring business model. But when the tide goes out they are still making money. They invest in businesses that produce a good, solid return and they grow as well.”

At the time Gledden and Brad Harris had decided to start an “income-oriented” private equity fund, which became Straight Bat.

“Small and medium businesses are the backbone of Australia, and being involved in that space and getting other high-net-worth individuals to invest in that space with a disciplined environment to me made sense,” Harris says.

Growth plans

When the firm’s maiden fund was launched two years ago, it was called the Generation 1 Fund, a name derived from an undertaking made by Brad Harris to make their families’ good-fortune last for five generations, to Geoff’s grandchildren’s grandchildren.

It initially set out to raise $100m to make five investments in a closed-ended fund that had a 10 year term. It has since changed its name to the Perpetual Legacy Fund and become open-ended.

Interestingly unlike traditional private equity firms, Straight Bat looks to pursue 50:50 partnerships with its investee companies.

“It is another thing that is a bit counter-intuitive to conventional PE. Most PE funds insist on 51-60 per cent ownership. The sentiment is ‘When things go wrong, you need to know I’m in control and if we don’t agree, I’ll be providing the marching orders.’ In our view that isn’t leadership. When you play the long game you see a business partnership like a marriage,” Gledden says.

Harris says it is about riding in tandem with founders. “We help them grow from medium to large, collecting the business experience. It gives them the chance to take on collective wisdom because everyone involved with

Straight Bat have been there and done that in our business journeys,” he says.

Harris recalls visiting the Keillor Park offices of RPM Hire on the outskirts of Melbourne to meet the company’s founder, Ashley Woodcock.

“It was on about three acres with just mud and weeds everywhere. Their office was in a prefab storage container. There I saw a young guy humming with enthusiasm and ideas but who probably didn’t have the skill really to take it to that next level as a national company,” he says.

“I talked to him about the lessons on the growth side of the company, and what mistakes not to make. Because I have made them all! And about his goals in five years, where he wanted to be and how I thought we’d be able to, through our business family, to help him achieve those goals.”

Woodcock is now keen to take the business to the public markets, which Harris is happy to help with. “I said to him If you do go down that path, I’m happy to sit on your board as someone who’s been through it. Because the investment community wants to see people who’ve had some degree of credibility in IPOs.

Flight Centre floated to the public in 1995 at 95c per share. It hit the boards at $1.24 and in about five years, it was up around $28,” Harris says.

Moral commitment

He still stays in touch with Flight Centre CEO Graham Turner and his other co-founders – now all in their 70s – and they still get together at least four times a year.

He reckons Turner doesn’t get the recognition he deserves for building a genuine global company from scratch.

“If he was based in Sydney and Melbourne rather than Brisbane, he would have a higher profile. He is a bit unconventional as well and he is still in the chair at 73 years of age. But he was incredibly resilient through Covid. He is one of those blokes who is just like a bulldozer. He just keeps on going,” he says.

What Harris values most about Straight Bat, operating in a sector which has had a questionable reputation over time, is integrity.

“The way traditional private equity works, loading companies full of debt, cutting half the staff and floating them, is totally the opposite of what we’re trying to achieve here. It’s a long-term partnership with business owners. It is about adding value and paying a dividend to our investors,” he says.

In Straight Bat’s Richmond office in inner city Melbourne, five cricket bats sit encased in a frame in the corner of the boardroom. They are full of the signatures of the founders, senior team and advisers of the firm’s first investee companies and Straight Bat’s principals.

Harris says it is a recognition of the moral commitment all have made to each another.

“I have always said to my son, Brad, and anyone else that is silly enough to listen to me that reputational damage is critical,” he says.

“If you lose your reputation, it is so difficult to get it back. So you’ve got to conduct yourself in life well. What goes around, comes around.”